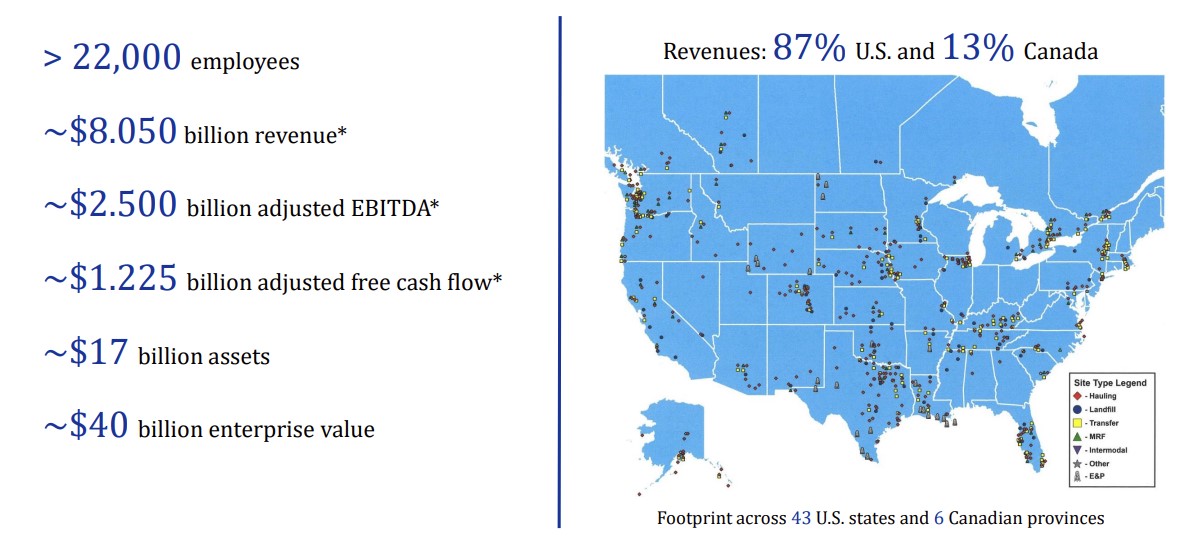

Founded in 1997, Waste Connections is the third largest solid waste management company in North America. It provides waste collection, transfer, recycling and disposal services. The company also provides petroleum waste treatment services (recovery and disposal), as well as intermodal services for the transportation of freight and solid waste by rail. It serves 43 US states and 6 Canadian provinces.

Source : Waste Connections

Waste Connections, not to be confused with its competitor and market leader Waste Management, is undoubtedly one of the most qualitative of the leading companies. It boasts an asset base of the highest quality, a high return on invested capital and a management team that's right on the mark. The company owns its landfills and controls the entire waste flow (collection, treatment and recycling). Owning landfills is a strategic advantage in collection operations due to competitive and regulatory factors. The company also focuses on providing integrated services, from collection to disposal of solid waste in the landfills they operate. Through ownership of its landfills, it has the highest pricing power in the sector, enabling it to outperform its competitors in terms of growth and predictability of results. Regular, highly successful acquisitions have also enabled it to consolidate its position in rural and secondary markets, a point to which we'll return later in the article.

Growth since the company was founded in 1997 has been nothing short of impressive. Sales, the number of landfills and the number of employees have exploded. In 2022, Waste Connections celebrated its 25th anniversary at the end of a year of strong growth. Faced with a difficult geo-political and inflationary context, the company once again demonstrated the solidity of its business model. The American company now employs over 22,000 people at 793 sites throughout the United States and Canada, and generates sales of over $7 billion. Total returns to shareholders (increase in share price + cumulative dividend payments) have been +5.846% in 25 years.

Source: Waste Connections

In 2022, the company achieved good results thanks to organic growth and strategic acquisitions: sales were up 17.2% on the previous year, and free cash flow increased by 15.4%.

This is the key to Waste Connections ' success in a low-growth market:

- The acquisition of small businesses in oligopoly/monopoly market niches (notably less competitive secondary and rural markets) ;

- Optimizing costs, creating synergies, opening up to more profitable segments and raising prices.

The acceleration in prices throughout 2022 and the acquisitions made during the year provide a strong impetus for 2023. Indeed, Waste Connections increased its capital expenditure by 23% and made 24 acquisitions in 2022, all while increasing its FCF. These investments, totaling $3.25 billion, will drive growth in 2023. A total of $668 million was redistributed to shareholders in 2022, through both cash dividends ($243 million) and share buybacks ($425 million). Waste Connections has been paying a dividend since 2010, growing at a rate of around 15% a year (+14.7% in 2022).

Margins are very attractive, revealing the company's competitive edge (or at least the sector's barriers to entry), with a gross margin of 40%, an operating margin of 17.5% and a net margin of 11.5%. The accounting profit is perfectly reconcilable with the cash profit, given that the FCF margin is close to 12%. Return on equity (ROE of around 12% over the past two years, forecast at 14.5% this year) and return on net assets (ROE of around 12% over the past two years, forecast at 14.5% this year) are very good.e) and net assets (ROA around 5.7% over the last two years and forecast at 6% this year) are decent, but well below Waste Management's performance.

The management team is experienced, with the same director at the helm since inception. Despite his recent appointment as CEO in 2023, Ronald J. Mittelstaedt was CEO from 1997 to 2019 and then Executive Chairman from 2019 to 2023. Mittelstaedt has over 30 years' experience in the solid waste industry. He also owns $30 million of the company's shares, which ensures a certain alignment with shareholders.

The company generates a small proportion of its sales from waste recycling. Waste Connections can continue to improve its recycling margins over the long term thanks to automated sorting and cleaning systems, and waste recovery is still in its infancy. Waste also has projects for the beneficial re-use of landfill gas through its network of landfills. The methane extracted can be used to produce clean energy. Although this represents less than 5% of sales, these segments are expected to grow strongly over the next decade.

However, recovery is not a given. This is usually the price to pay for this kind of qualitative business, with barriers to entry, good visibility and recurring results. In terms of valuation ratios, we currently stand at 36 times expected net earnings for 2023 (but still 25% below its historical average), 16.6 times enterprise value to EBITDA (in line with its historical average) and 34 times free cash flow, i.e. a cash yield of 2.9%. This is acceptable if you have a long time horizon.

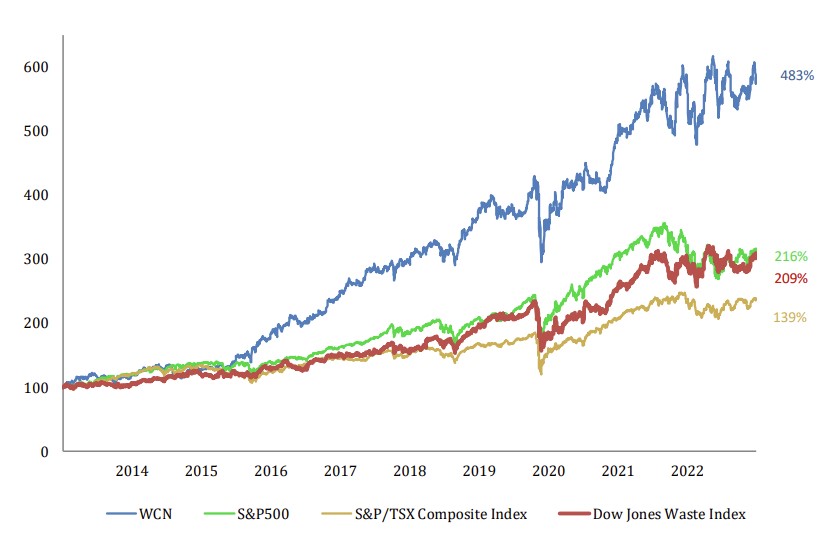

Over the past decade, the share price has risen twice as much as the S&P 500, a testament to growth outstripping GDP and to management's remarkable execution. Add to this steady organic growth a fantastic track record of external growth, and we have a company that holds all the cards to continue rewarding its shareholders.

Source : Waste Connections

By

By